TMGvets exists to help make life easier on your small business. Trinity Merchant Group, or TMGvets, offers veterinarians and other small business types with a diversity of options so that you are equipped with the tools you need to take your business to the next level.

In the modern era, it is essential for a veterinary clinic to have a sophisticated understanding of the variety of options available to them. Whether we are discussing e-commerce payments, virtual terminals, mobile payments, business-to-business credit card processing solutions, or just payment processing in general, it’s easy to understand that having access to quick and efficient merchant services can be invaluable to a business.

This is especially the case considering the digitization of commercial payments in practically every vertical imaginable. As Wilko Bolt and Sujit Chakravorti noted in their research paper titled “Digitization of Retail Payments”, there exists an accelerated trend in the progress of digital retail interaction within both computing and telecommunications. “The proliferation of payment cards continues to change the way consumers shop and merchants sell goods and services. Recently, some merchants have started to accept only card payments for safety and convenience reasons…Wider acceptance and usage of payment cards suggest that a growing number of consumers and merchants prefer payment cards to cash and checks. Furthermore, without payment cards, internet sales growth would have been substantially slower.”

Ease-Of-Use

Veterinary clinics prove to be no exception to this rule described above. If you and your business are serious about competing in this virtual marketplace, you have to have both speed and security as integral features of your payment processing system. Speed and ease-of-use are going to be the most preponderant aspect of your merchant services; you could easily miss out on a valuable slice of e-commerce sales if your payment experience is slow, hard to understand, or sub-par for another reason.

Security

Whether we are discussing online payment processing, mobile credit card processing, or a physical credit card terminal, security is an aspect of your business in which you must be implicitly trusted by your client base. Luckily, most consumers do carry a natural trust of online payment gateways – unless they are proven wrong. It’s like your mother or father might have told you, until you give them a reason to doubt or not trust you, your leash will be pretty long. If, however, that trust is broken, rebuilding it might prove to be a costly enterprise.

Now that we’ve accomplished a sense of context in our (somewhat lengthy) introduction, let’s get to the promised topic at hand! Keep reading if you are interested in understanding the key differences between virtual terminals and payment gateways. Let’s get going!

What Is A Payment Gateway?

A payment gateway is usually shorthand for an online payment gateway that is setup to function the way a credit card terminal would work at a physical, brick and mortar store. A payment gateway is a “merchant service” that is offered to business by an e-commerce application service provider, like Trinity Merchant Group (that’s us!), to administer and authorize direct payments or credit card transactions. This service is utilized by brick and mortar businesses, “bricks and clicks”, or exclusively e-commerce stores.

If you want to get technical in your understanding of payment gateways, here is your chance. A purchaser’s credit card details are encrypted before the payment goes through the payment gateway. Once this is accomplished, the information goes to your (the vendor’s) bank’s processor. The final step is for the payment to be processed by the credit card network and to be approved by the purchaser’s credit card issuing bank. Suffice it to say, there’s a whole lot going on in the two seconds it takes for your grocery store purchase to get approved!

What Is A Virtual Terminal?

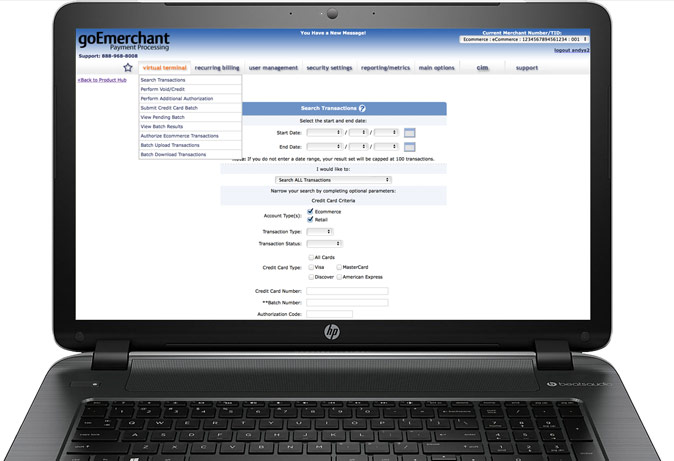

Excellent question, we are so glad you asked! Virtual terminals, also known as VT, are computer programs that essentially mirror the process of a typical payment terminal. Roughly speaking, a virtual terminal affords a computer the capacity to sync with a remote server in order to either run an application or administer some sort of file transfer. One of the benefits of a VT is that the server and PC in question do not have to have the same operating systems, but are able to interact with common network protocols that include FTP, Telnet, and the like. More often than not, virtual terminals, also called terminal emulators, have some sort of command-line interface, which serves as a layer of security in that it necessitates cryptic commands in order to interact with a server.

Less Jargon, More Value

Complicated enough for you? Let’s break it down to more practical terms for small business owners. If you are a veterinarian, a virtual credit card terminal is a means for you to accept credit by logging into an online account to manually enter a credit card sale(s). No other hardware, programs, or equipment is required. That is valuable for a small business owner looking to streamline their processes.

What’s The Difference?

So the key difference between payment gateways and virtual terminals is that payment gateways are used in e-commerce transactions, whereas virtual terminals are exclusively used by merchants. Thus, an online payment gateway has a customer-facing interface. Online payment gateways typically are able to support accounting software integration, allow for recurring billing, and support other unique features. Virtual terminals boast advantages that include being able to support mail orders, telephone orders, and other flexible features that are dependent on the specific merchant service provider and their functionality.

TMGvets’ Virtual Terminal

Now that we’ve developed a better understanding of VTs, payment gateways and the advantages of each, allow us a moment to talk about some of the advantages going with TMG. The bottom line is that no two retailers are alike, and that is why we have developed our services to be as customizable as possible. Some of our baseline features include the following.

- The utilization of extensive analytics

- Fully PCI-DSS Compliant

- Offer more payment options to your customers

- Automated recurring billing for repeat customers

- Unlimited users for large organizations

- Free fraud prevention tools

Our payment processing includes the functionality to work with all major credit cards, signature debit cards, and eCheck processing.

At the end of the day, you can get a custom rate quote for the specific, tailored merchant services your veterinary clinic needs to not only survive, but succeed. Our goal is to provide value to merchants, whether it’s saving money, offering new technology, or simply providing superior service. Get in touch with a payment processing provider that delivers more than is expected. Get your custom rate quote today.